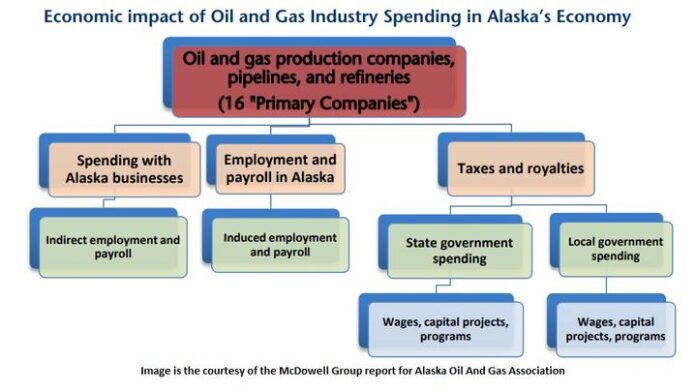

As Guyana stands on the cusp of significant oil production, we can look to established models to better understand the potential benefits this industry can bring to our citizens. One such model is the oil industry in Alaska, which has been carefully examined in a report titled “The Role of the Oil and Gas Industry in Alaska’s Economy,” a document prepared in May 2014 for the Alaska Oil and Gas Association by the McDowell Group.

The report highlights the economic impact of oil and gas spending in Alaska and offers a potential template for Guyana’s government to develop policies and legislation that can ensure long-term prosperity for Guyanese citizens. It demonstrates how oil revenues can support critical public services, education, healthcare, and even direct financial payments to citizens.

Population Parallels and Key Differences

In 2013, Alaska’s population was approximately 736,760, while Guyana’s population stood at 758,081, numbers that are strikingly similar. However, the significant differences between the two regions are evident in the areas of talent, infrastructure, and government policies. Alaska’s well-developed infrastructure and mature oil industry provide valuable lessons for Guyana, which is still in the early stages of its oil production journey.

One of Guyana’s foremost economists, Professor Clive Thomas, proposed that some portion of the oil revenue should be allocated as cash transfers to every Guyanese household. He suggests that this could equate to as much as USD 5,000 annually per household, ensuring that every citizen benefits directly from the country’s oil wealth. Alaska has successfully implemented a similar system with its Permanent Fund Dividend, where Alaskan residents receive an annual payout based on the length of their residency.

In 2013 alone, 631,470 Alaskans received a total of $536 million from the state’s oil fund. Guyana could consider adopting a similar model, distributing a portion of oil revenue to its citizens while ensuring that adequate safeguards are in place to avoid inflationary pressures.

Lessons for Guyana’s Legislative Agenda

Several key points from the Alaskan model should serve as inspiration for Guyana’s policymakers:

-

Tax Relief for Citizens: Alaska is the only state in the U.S. without a state sales tax or personal income tax, thanks to its substantial oil and gas revenues. In FY2013, the oil and gas industry paid $7.4 billion in taxes and royalties to the state, representing nearly half of all state revenue. Similar reforms could be explored by Guyana’s government to provide financial relief to its citizens while still investing in public services and infrastructure.

-

Education and Social Services: Oil revenues in Alaska are a critical funding source for public services. In 2013, oil revenues supported 90% of the state’s unrestricted revenue, funding public education, healthcare, and other vital services. Alaska’s public schools received an average of $8,170 per student from oil revenues. Guyana could consider using a portion of its oil revenues to similarly support education, healthcare, and poverty alleviation programs.

-

Direct Payments to Citizens: Alaska’s oil dividend program, which began in 1982, provides an annual payout to every resident. Over time, these payments have significantly boosted household incomes. Since 1959, Alaska has collected $157 billion (adjusted for inflation) from oil, with a portion of this money distributed directly to citizens. For Guyana, a structured and equitable payout system could be developed, based on residency and other criteria, to ensure that oil wealth benefits everyone.

Moving Forward: Guyana’s Roadmap

While Guyana is still in the early stages of its oil industry, it is crucial to take a long-term view. Drawing from Alaska’s model, here are several proposals that could be implemented:

-

Equitable Payouts: A formula for cash transfers to citizens, similar to Alaska’s Permanent Fund, could be created. However, safeguards must be put in place to avoid runaway inflation. One suggestion is that oil fund payouts be directed toward long-term investments, such as property acquisition, which could not be sold for 30 years unless developed.

-

Education Investment: Oil revenues should be used to fully fund the education sector, ensuring equal access to quality education across all regions. State-of-the-art facilities and digital learning platforms could provide remote communities with the same standard of education as those in urban areas.

-

Skills Training: Out-of-school and unemployed individuals should be offered training opportunities, with oil fund payouts serving as an incentive to complete skills development programs that enhance their chances of success in the workforce.

-

Infrastructure and Safety Standards: Guyana must prioritize the development of modern infrastructure, particularly in transportation. A Department of Transportation could be established to enforce international safety standards on roadways and vehicles, helping to prevent accidents and improve public safety.

Conclusion

Guyana’s potential as a new player in the global oil industry is immense. By learning from successful models such as Alaska, the country can ensure that its oil wealth is managed responsibly and equitably. With the right policies, investments, and oversight, Guyana can create lasting prosperity for its citizens while avoiding the pitfalls of mismanagement that have plagued other resource-rich nations. The time to act is now, and the possibilities for Guyana’s future are limitless.

This editorial highlights key lessons from Alaska’s experience and offers concrete recommendations for Guyana’s oil policy. It encourages a long-term vision of wealth distribution, infrastructure development, and education investment to ensure the country’s oil boom benefits all its citizens.