Shares of Greenheart Group, the Hong Kong-listed subsidiary of embattled mainland timber company Sino-Forest, were dragged down yesterday by fraud allegations against its parent.

Shares of Greenheart Group, the Hong Kong-listed subsidiary of embattled mainland timber company Sino-Forest, were dragged down yesterday by fraud allegations against its parent.

Short-seller Carson Block published research on June 2 alleging Toronto-listed Sino-Forest exaggerated land holdings and sales in Yunnan province. Sino-Forest denied the claims and said it was considering legal action against Block and his company, Muddy Waters Research.

Trading in Greenheart’s shares was halted on Friday but resumed yesterday, plunging 63 per cent to close at HK$1.03. At press time, Sino-Forest’s stock was languishing at C$4.01 (HK$31.90), 78 per cent below its June 1 closing price.

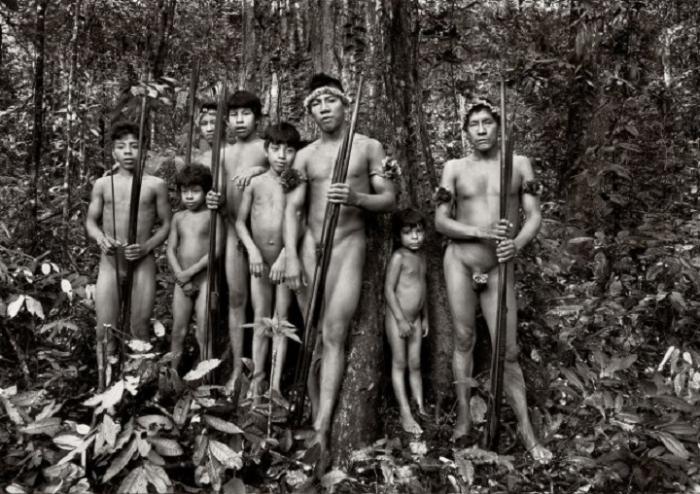

Greenheart, which owns tree plantations in New Zealand, Suriname, Guyana and French Guiana, said on Tuesday night that its business was ‘not the subject’ of Muddy Waters’ allegations and it would ‘continue to operate as normal’.

Greenheart describes itself as Sino-Forest’s ‘acquisition vehicle for high-quality international assets’. It is 64 per cent owned by Sino-Forest.

Sino-Forest chief executive Allen Chan is one of Greenheart’s non-executive directors. Simon Murray, chairman of commodities giant Glencore, sits on the Sino-Forest and Greenheart boards.

GEMS, a private equity fund chaired by Murray, bought a US$25 million convertible bond issued by Greenheart last August.

Block, who stands to profit handsomely from his short position in Sino-Forest, did not mention Greenheart in his June 2 report.

‘If there are any allegations against Greenheart then Greenheart will act accordingly,’ company investor relations director David Wu said.

On Monday, Sino-Forest released land-related documents on its website in an attempt to discredit Block’s research. The timber firm says it has 186,700 hectares of plantations in Yunnan. Muddy Waters alleged that from reviewing city records and interviewing one of Sino-Forest’s agents, the company had just 20,000 hectares in the province.

The documents Sino-Forest published on Monday included selected plantation contracts in Yunnan covering just 2,036 hectares of land.

As private companies cannot own agricultural land on the mainland, forestry firms sign land use agreements with local governments.

Nomura credit analyst Annisa Lee raised further questions over the Toronto-listed company’s sales data.

Sino-Forest states that its top customer was responsible for 17 per cent of its sales last year, equating to US$325 million.

Lee wrote in a June 7 research note that she could not identify a mainland timber buyer large enough to make such orders.

‘Most buyers of standing timber and wood logs are provincial or even county-based traders with relatively small operations,’ Lee wrote.

A Sino-Forest spokesman declined to comment.